LLP is an alternative corporate business form that gives the benefits of Limited Liability of a Company and the flexibility of a Partnership.

Limited Liability Partnership

LLP is an alternative corporate business form that gives the benefits of Limited Liability of a Company and the flexibility of a Partnership.

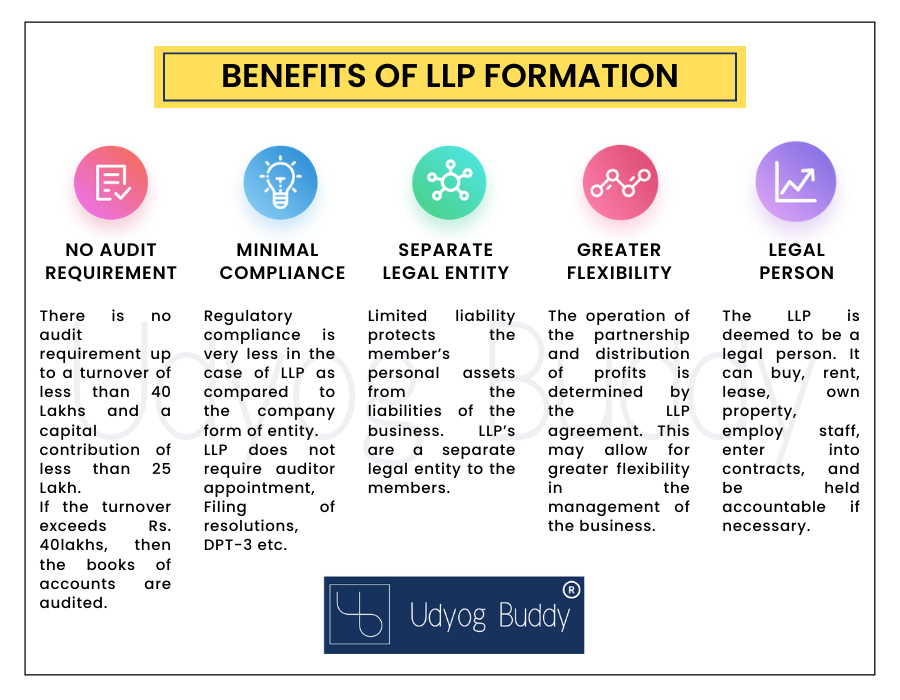

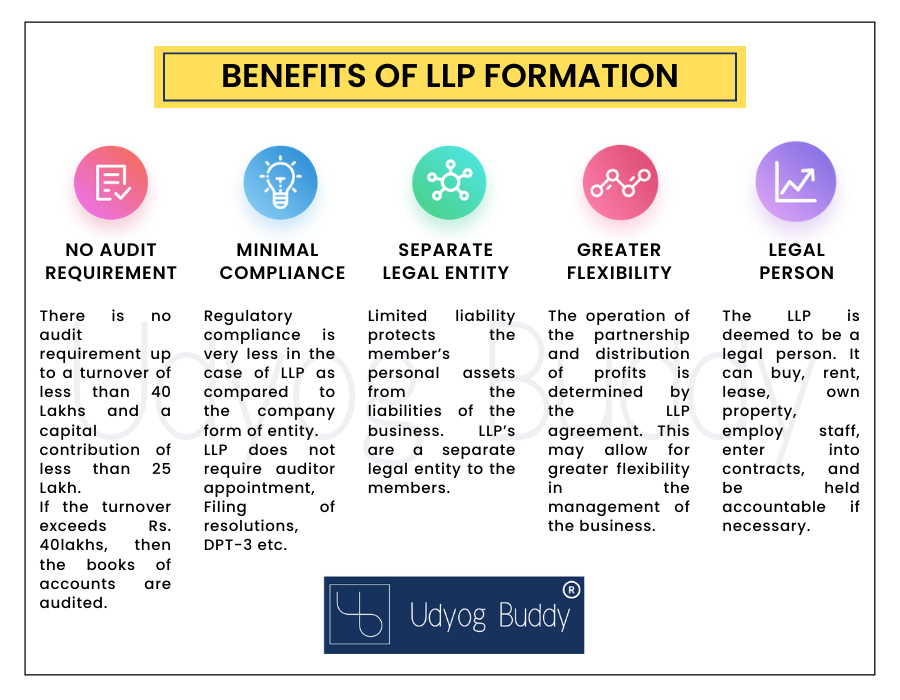

The LLP is a Separate Legal Entity and is liable to the full extent of its assets but the liability of the partners is limited to their agreed contribution in the LLP.

The LLP formation is popular when a ‘Professional Partnership’ would like the benefit of protected liability. This is particularly suited to accountants, architects, consultants, surveyors, and other fields of expertise where a partnership is preferred to a limited company.

Within an LLP the earnings of the members are normally seen as personal income.

Recent significant updates include the LLP (Second Amendment) Rule, 2022

A few more important changes have been made through LLP (Second Amendment) Rule, 2022, which are as follows:

All the Forms of LLP now became web based including LLP Formation.

5 (Five) Designated partners (without having DIN) shall be allowed at the time of Incorporation.

Latitude and Longitude is compulsory to be mentioned in the address block.

Each and every change in LLP Agreement have to be marked in Form 3 with precise information.

Directors Details can be fetched from Digi Locker Database.

Contingent Liability Reporting is now specifically included in Form 8 (Statement of Solvency and Annual Return).

DSC of all the Designated Partners will be required at the time of Incorporation of LLP as the Form 9 made web based.

Penalties and Compounding of offences to be reported in Form.

LLPs shall be allotted their PAN along with the Certificate of Incorporation itself.

.text-with-image {

position: relative;

text-align: center;

color: white;

}

.centered-image {

position: absolute;

top: 50%;

left: 50%;

transform: translate(-50%, -50%);

}

Your Text Here

Your Text Here

Documents Required for LLP Registration

Scanned copies of:

Aadhar Card, PAN Card, Email Id & Mobile Number of all Partners

Identity Proof of all partners (Passport, Driving License, or Voter ID Card)

Address Proof of all partners (Bank Statement or Passbook, electricity bill, telephone bill, Aadhar Card, or any utility bill).

Registered Office Address Proof – Electricity Bill along with NOC from the owner (if rented), or any other ownership proof of proposed registered office.

Passport Size Photograph, mobile number, and email address.

Note : All documents shall be self-certified. There is no requirement for submitting physical documents.

Conclusion

Now, what is LLP, and how it is an attractive vehicle for undertaking business in India have been viewed. We would like to point out that our organization is registered as an LLP – Udyog Buddy Advisory LLP.

An LLP is preferred due to its simple process for formation/unwinding and does not involve too many legal formalities. Typically, 10-15 days is required for registering an LLP seeking the professional expertise of team Udyog buddy, subject to government approval.

Hence, if you are looking for a simple structure of business then you must go with starting your LLP. At Udyog Buddy, our team of professionals will help you seamlessly Incorporate your LLP and start your dream business with hand-holding support and affordable prices.

Why Choose Udyog Buddy ?

Udyog Buddy is a team of experienced professionals, our end-to-end service model, combined with personalized support, makes the incorporation journey straightforward and stress-free. Additionally, our commitment to cost-effective solutions and time efficiency allows businesses to focus on growth and operations without unnecessary delays or financial strain. Choosing Udyog Buddy means partnering with a trusted expert dedicated to helping your business succeed from the very start.

Connect with us for any queries

Call/WhatsApp +919301789019 or E-mail at hello@udyogbuddy.com

The stamp duty for LLP Agreement depends from state to State. Click here to view the Stamp duty.

A LLP needs to mandatorily file certain documents and information such as filing of Income Tax Return, Form 11, Form 8, Annual meeting etc. with concerned ROC/IT department.

LLPs are required to have its accounts audited by a Practicing Chartered Accountant only if its annual turnover, in any financial year exceeds Rs. 40 lakhs or its contribution exceeds Rs. 25 lakhs.

LLP agreement is made between the Partners and the LLP regarding the relationship between the individual partners in LLP.

LLP agreement usually consists of policies, the inclusion of new partners, policy-making strategies, capital contribution, etc.

Yes, it is much cheaper to run an LLP than a private limited company, because compliances such as an audit, apply to LLPs only after their turnover crosses Rs. 40 Lakhs.

Minimum of two designated partners are required to start an LLP. The designated partners are responsible for fulfilling all the essential requirements involved in starting and running an LLP.

Yes, an existing partnership firm can be converted into LLP by complying with the Provisions of clause 58 and Schedule II of the LLP Act. Form 17 needs to be filed along with Form 2 for such conversion and incorporation of LLP.

Foreign LLP can establish a place of business in India by filing Form 27 giving the particulars of incorporation of foreign LLP, details of DPs/ partners of that foreign LLP and details of at least two authorised representatives for complying with regulation of LLP act.

LLP is required to file LLP Form 8 (Statement of Account & Solvency) within 30 days from the end of six months of the financial year to which it relates and LLP Form 11 (Annual Return) annually to be filed within 60 days of close of the financial year.

Yes, the LLP can be registered at the owner’s residential address. A copy of the utility bill along with NOC from owner is required to be submitted.

Yes, the same person can act as Partner and Designated Partner of the LLP.

What Other Services We Offer

We provide the best service by delivering exceptional quality, exceeding expectations, and prioritizing customer satisfaction.

Private Limited Company

Limited Liability Partnership

One Person Company

GST Registration

For certain businesses, GST registration is mandatory. If any organization carries on the business without registering under GST, it is an offence under GST and heavy penalties will apply.

Startup India Registration

Start-up India is a flagship initiative of the Government of India, intended to catalyse Start-up culture and build a strong and inclusive ecosystem for innovation and entrepreneurship in India.

FSSAI Registration

Obtaining an FSSAI license is mandatory before starting any food business operation in India. All the traders, manufacturers, etc. who are involved in the food business must obtain a FSSAI Number.

ISO Registration

ISO refers to International Organization for Standardisation. ISO Certification is mandatory to form certain standards that ensure the quality, safety, and efficiency of products and services.

Trademark Registration

A trademark can be any word, phrase, symbol, design, or combination of these things that identifies your goods or services. Get your Trademark application filed within 24 hours.

Copyright Registration

With copyright registration, you become a legal owner of your creative work in respect of books, paintings, music, website, etc. It secures the creative work of the author.

ITR Filings

Get an expert to do your taxes with an end-to-end online assistant. Take the first step towards income tax e-filing and file it today!

Agreement Drafting

Simplify your Complicated Documentation with us. We offer all types of documents whether it’s an Agreement, Contract, Affidavit, Notice or many more.